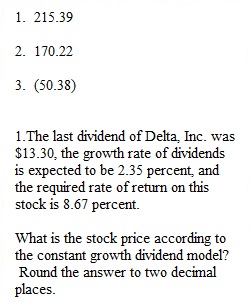

Q 1.The last dividend of Delta, Inc. was $13.30, the growth rate of dividends is expected to be 2.35 percent, and the required rate of return on this stock is 8.67 percent. What is the stock price according to the constant growth dividend model? Round the answer to two decimal places. 2.The next year the common stock of Gold Corp. will pay a dividend of $7.97 per share. If the company is growing at a rate of 5.75 percent per year, and your required rate of return is 14.68 percent, what is Gold's company stock worth to you? Round the answer to two decimal places. 3.The Black Forest Cake Company just paid an annual dividend of $8.76. If you expect a constant growth rate of 2.99 percent, and have a required rate of return of 8.29 percent, what is the current stock price according to the constant growth dividend model? Round the answer to two decimal places. 4.You are considering the purchase of a share of Alfa Growth, Inc. common stock. You expect to sell it at the end of one year for $51.71 per share. You will also receive a dividend of $3.53 per share at the end of the next year. If your required return on this stock is 9.64 percent, what is the most you would be willing to pay for Alfa Growth, Inc. common stock now? Round the answer to two decimal places. 5.Green Company's common stock is currently selling for $66.29 per share. Last year, the company paid dividends of $4.94 per share. The projected growth at a rate of dividends for this stock is 5.08 percent. Which rate of return does the investor expect to receive on this stock if it is purchased today? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box).

View Related Questions